The Equal Credit Opportunity Act (ECOA) is designed to provide fair and equal access to credit, based on individual creditworthiness, without regard to a prohibited basis such as race, gender, or national origin. The Consumer Financial Protection Bureau has issued regulations under ECOA. These regulations, known as Regulation B, provide the substantive and procedural framework for fair lending. What are the requirements and steps should be taken to remain in compliance?

About the Authors:

Marlon Bates is a partner at Scalley, Reading, Bates, Hansen & Rasmussen and has served as managing partner at the firm twice. He practices real estate and business law, including both transactional work and litigation, and represents a wide variety of clients including banks, mortgage companies, credit unions, loan servicing companies, title insurance companies, property managers, developers, landlords, real estate brokers and many other businesses.

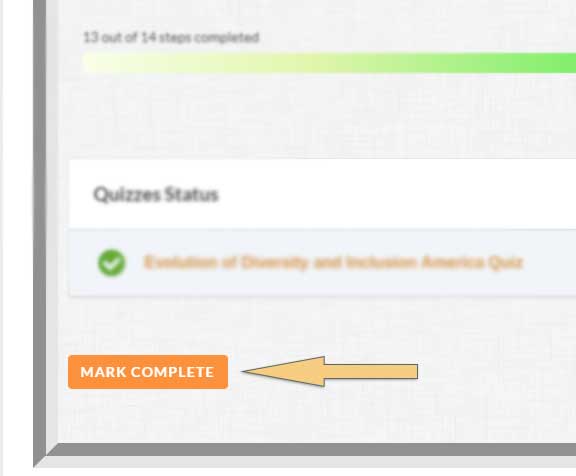

As you progress through a course, please ensure to click the ‘Mark Complete‘ button at the end of each lesson.